What is Smishing?

Smishing is a specific type of phishing attack that uses social engineering tactics to deceive individuals into revealing sensitive information. Unlike traditional phishing, which often occurs through email, smishing is executed through text messages (SMS). The attacker, known as a smisher, typically poses as a trusted entity, such as a bank, government agency, or tech support representative, to trick the recipient into sharing personal information like passwords, credit card numbers, or other confidential data.

One of the reasons smishing is effective is that many people inherently trust text messages more than other forms of communication. They may be more inclined to respond to a text message that appears to come from a familiar source. Smishers exploit this trust, often crafting messages that create a sense of urgency or importance, compelling the recipient to act quickly without thoroughly verifying the message’s authenticity.

To protect against smishing, it is crucial to understand not only what smishing is but also how it operates. Recognizing the tactics used by smishers, such as impersonating legitimate organizations or creating fake scenarios to solicit sensitive information, is key to avoiding falling victim to these attacks. Additionally, it’s important to differentiate smishing from other forms of phishing, like vishing, to better prepare yourself and your organization to detect and prevent these threats.

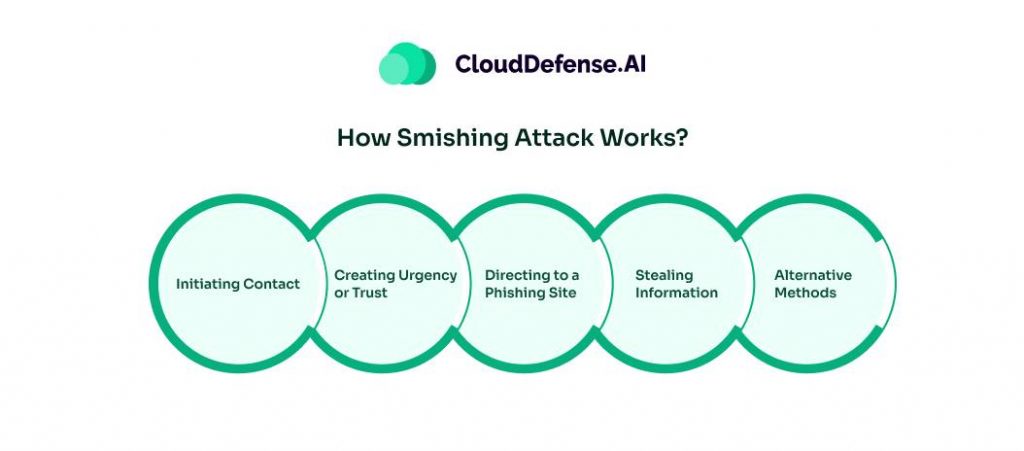

How Smishing Attack Works?

Smishing attacks are sophisticated schemes that aim to steal personal information through deceptive text messages. These attacks typically unfold in several steps, each carefully designed to manipulate the recipient into divulging sensitive data.

Initiating Contact

The attack begins with a seemingly legitimate text message sent to the target’s phone. In some cases, these texts are not actual SMS messages but emails that are made to appear as text messages. The sender may pose as a trusted organization, such as a bank, government agency, or tech support, to create a sense of authenticity. Interestingly, the attacker might not even have the target’s phone number; instead, they use email-to-text services to reach the recipient.

Creating Urgency or Trust

The text message is often worded in a way that creates a sense of urgency or obligation. It might suggest that the recipient needs to take immediate action for legal reasons, financial gain, or to protect their assets. This psychological pressure makes the recipient more likely to respond without thoroughly considering the legitimacy of the message.

Directing to a Phishing Site

The smishing message usually contains a link to a website that appears legitimate. This site is carefully crafted to resemble the official website of the organization the attacker is impersonating. It may feature the correct logos, color schemes, fonts, and even official insignia to trick the target into believing they are on a trusted site.

Stealing Information

Once the recipient is on the fake website, they are prompted to enter personal information, such as account names, passwords, or credit card details. The moment this information is submitted, it is captured by the smisher, who can either use it for their own malicious purposes or sell it to others who will exploit it.

Alternative Methods

In some cases, smishing attacks are more direct. The initial text message might include a link that, when clicked, automatically downloads malware onto the recipient’s device. This malware can then be used to steal personal information without further interaction from the target.

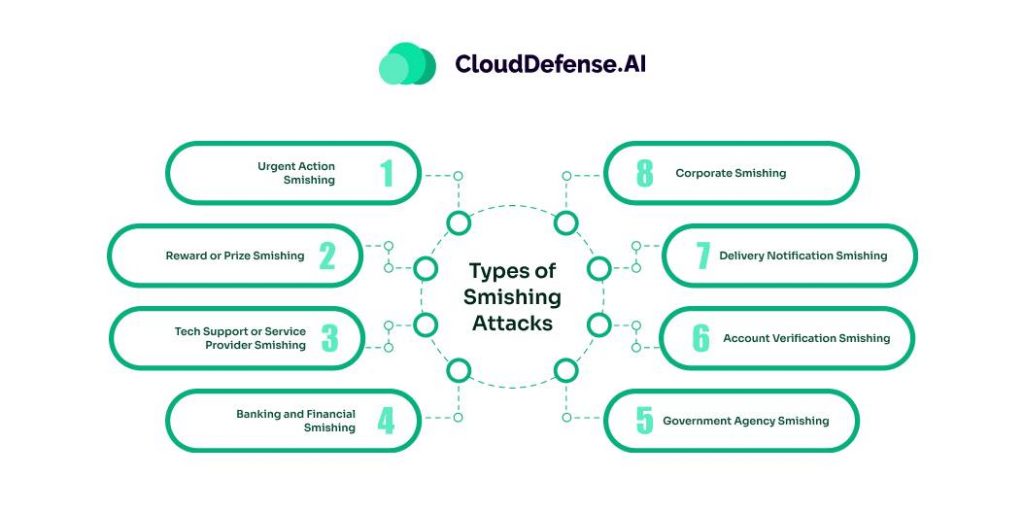

Types of Smishing Attacks

Smishing, a form of phishing conducted through text messages, can take on various forms, each designed to exploit different vulnerabilities and manipulate targets into divulging sensitive information. Here are some common types of smishing attacks:

Urgent Action Smishing

This type of smishing attack creates a sense of urgency, compelling the recipient to act immediately. The message may claim that the target’s bank account has been compromised, or that they owe a debt that needs to be paid off immediately to avoid legal consequences. The urgency of the message is intended to bypass the recipient’s usual caution, pushing them to provide personal information or make a payment without verifying the legitimacy of the request.

Reward or Prize Smishing

In this type of attack, the smisher tempts the recipient with the promise of a reward, such as a gift card, lottery winnings, or a special discount. The message might instruct the target to click on a link or enter their information to claim the prize. The excitement of winning or receiving something for free often causes people to lower their guard, making them more susceptible to sharing their personal details.

Tech Support or Service Provider Smishing

This attack involves the smisher posing as a tech support representative or service provider, such as a telecommunications company or software provider. The message might claim that the recipient’s account needs verification or that there is an issue that requires immediate attention. The target is then directed to a fake website or asked to reply with their credentials, which the attacker uses to gain unauthorized access to their accounts.

Banking and Financial Smishing

Banking and financial smishing attacks are particularly common and dangerous. The attacker impersonates a financial institution, sending a text message that appears to come from the victim’s bank or credit card company. The message may alert the recipient to suspicious activity on their account or ask them to verify a transaction. The provided link or phone number leads to a phishing site or directly connects to the smisher, who then extracts the victim’s financial details.

Government Agency Smishing

In this type of smishing attack, the attacker pretends to be a government agency, such as the IRS, Social Security Administration, or a local authority. The message might warn of unpaid taxes, legal issues, or the need to update personal information for benefits. The official-looking message can easily deceive the target into thinking it’s a legitimate request, leading them to provide sensitive data.

Account Verification Smishing

This smishing attack targets the recipient’s online accounts, such as social media or email accounts. The message might claim that the account has been locked or needs verification due to suspicious activity. The link provided leads to a fake login page designed to capture the user’s credentials. Once the attacker has these credentials, they can access the account, often leading to further exploitation or identity theft.

Delivery Notification Smishing

As online shopping grows, so do smishing attacks that exploit delivery notifications. In this type of attack, the smisher sends a message that appears to come from a courier service, claiming that a package is waiting for delivery or needs rescheduling. The recipient is prompted to click a link to track the package or provide delivery details, which can lead to a phishing site or the installation of malware.

Corporate Smishing

Corporate smishing targets employees within an organization, often impersonating an executive or HR department. The message may ask the employee to complete an urgent task, such as updating payroll information or reviewing a confidential document. These attacks are designed to gain access to sensitive company information, potentially leading to broader security breaches within the organization.

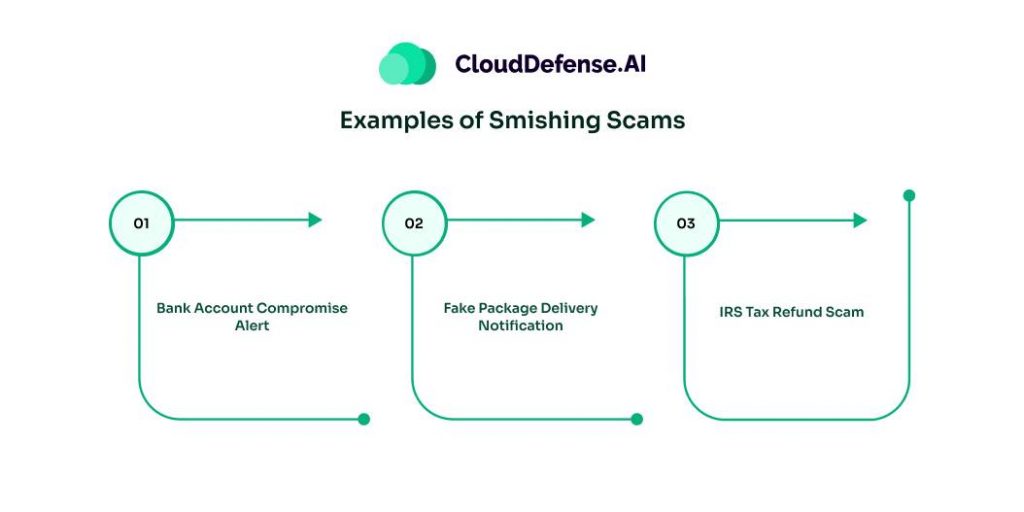

Examples of Smishing Scams

Here are three examples of common scams for you to learn more about smishing.

Bank Account Compromise Alert

You receiv a text message that appears to be from your bank, claiming that there has been suspicious activity on your account. The message might say, “Your account has been temporarily locked due to suspicious activity. Please click the link below to verify your identity and secure your account.” The link leads to a fake website that looks like your bank’s official site, where you’re prompted to enter your login credentials and possibly other personal information, which is then captured by the attacker.

Fake Package Delivery Notification

You receive a text message from what appears to be a popular courier service, like FedEx or UPS, stating, “Your package is out for delivery. Please click here to confirm your delivery address: [malicious link].” Clicking the link might take you to a fraudulent website that asks for personal details or automatically downloads malware onto your device. The attacker uses this information to steal your identity or gain access to your accounts.

IRS Tax Refund Scam

During tax season, you receive a text message claiming to be from the IRS, saying, “You are eligible for a tax refund. Click the link to claim your refund now: [malicious link].” The link directs you to a fake IRS website that looks legitimate and asks for your Social Security number, bank account details, and other sensitive information. The attacker then uses this data for identity theft or financial fraud.

How To Protect Yourself From Smishing Attacks?

Education is one of the most powerful tools in preventing smishing attacks within an organization. Attackers often use various tactics to deceive their targets, but many smishing attempts share common characteristics. By ensuring that all employees and executives understand the different forms of smishing, you can better equip them to recognize and avoid these threats.

Here are some key strategies to protect yourself from smishing attacks:

- Question Urgent Requests: Be wary of any message that demands immediate action or creates a sense of urgency. Attackers often use urgency to pressure you into making hasty decisions. Always take a moment to verify the legitimacy of the message before responding.

- Avoid Clicking on Links in Text Messages: Refrain from clicking on links embedded in text messages, even if they appear to be from a trusted source. If you need to visit a website mentioned in a text, type the URL directly into your browser instead of clicking the link.

- Verify the Sender’s Number: Always check the phone number that sent the message, especially if it’s asking for personal information or prompting you to click a link. If the number looks unfamiliar or suspicious, it could be a smishing attempt. Do not interact with the message until you can confirm its authenticity.

- Secure Your Financial Information: Avoid storing sensitive information, such as banking or credit card details, on your phone. Smishing attacks can sometimes lead to the installation of malware, which could give attackers access to your stored data.

- Ignore Unknown Senders: If you receive a text from an unknown sender, do not reply or click on any links within the message. Ignoring these texts can prevent you from falling victim to smishing scams.

- Report Smishing Attempts: If you encounter a suspected smishing attempt, report it to the Federal Communications Commission (FCC). This can help authorities track and prevent further attacks, protecting other potential victims.

- Avoid Responding to Account Update Requests: Never respond to text messages that ask you to update or change account information. Legitimate organizations will not request such changes via text message. Always go directly to the official website or contact the organization through verified means to make any updates.

Final Words

Smishing is a pervasive threat that requires vigilance and proactive measures to counter. By understanding the tactics employed by scammers and implementing effective security practices, you can significantly reduce your risk of falling victim to these malicious attacks. Stay informed, be cautious, and protect your digital identity from the ever-evolving landscape of smishing scams.