What is Internet Fraud?

Internet fraud, also known as online fraud, includes a wide range of criminal activities conducted over the Internet. This form of cybercrime includes identity theft, password and data theft, scams, and digital kidnappings, all of which aim to deceive individuals or businesses for financial gain.

For e-commerce site owners, understanding the details of internet fraud is essential to implementing adequate protections and minimizing risks. At its core, internet fraud involves the unauthorized use of personal or financial information to commit crimes.

One common type is identity theft, where cybercriminals steal personal information such as Social Security numbers, credit card details, or bank account information. This stolen data is then used to make unauthorized purchases, apply for loans, or commit other fraudulent activities.

Internet fraud continues to escalate globally, with significant financial and personal impacts. In 2023, U.S. consumers reported losses exceeding $10 billion to fraud, marking a 14% increase from the previous year. Investment scams led to these losses, accounting for over $4.6 billion, a 21% rise from 2022.

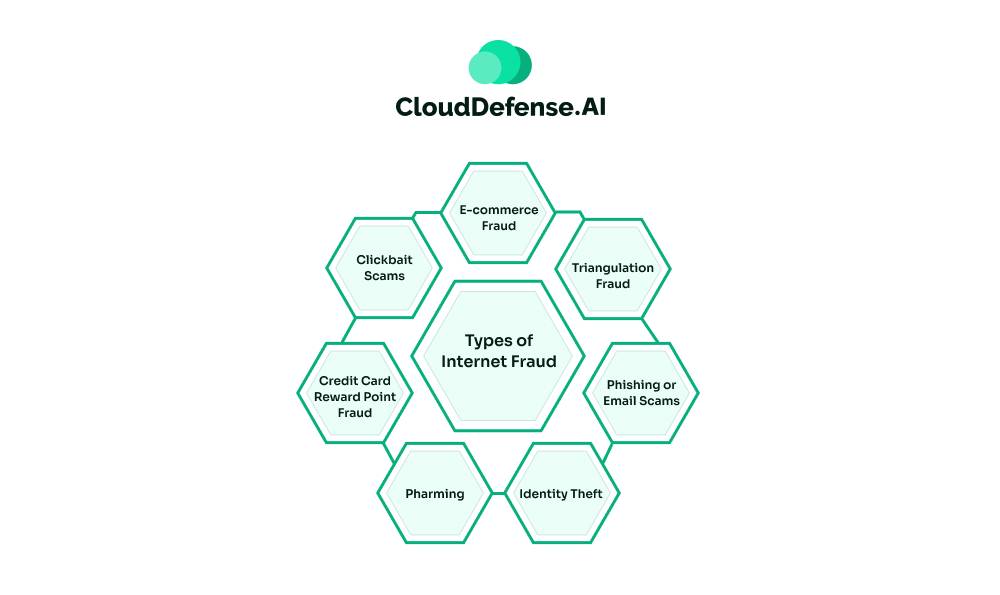

Types of Internet Fraud

Internet fraud isn’t a monolith; it includes a multitude of deceptive practices, each more cunning than the last. Criminals constantly innovate, devising new schemes to exploit unsuspecting victims. Here are some of the most prevalent types of online fraud:

E-commerce Fraud

E-commerce fraud spans various tactics, from identity theft to fraudulent credit card reward schemes. In the realm of online shopping, these deceptive practices can impact anyone. However, with the right knowledge and preventative measures, the risks can be mitigated.

Triangulation Fraud

Triangulation fraud is notoriously difficult to detect. In this scheme, a scammer sets up a fake virtual store on an online marketplace, offering products at prices that are too good to be true. When a customer makes a purchase, the scammer uses a stolen credit card to buy the item from a legitimate retailer. The customer receives the product, unknowingly purchasing stolen goods, while the scammer escapes with the money.

Phishing or Email Scams

Phishing scams involve fraudulent emails that mimic those from trusted sources, such as banks or utility providers. These emails prompt recipients to verify their information or click on links to fake websites. Once clicked, the victim unknowingly provides sensitive information, including usernames, passwords, and bank details, to fraudsters. To combat this, ensure your e-commerce site has a valid security certificate and educate customers about recognizing suspicious URLs.

Identity Theft

Identity theft is rampant due to the vast amount of personal information available online. Scammers assume another person’s identity, often to use their credit card information for fraudulent purchases. In e-commerce, this type of fraud is particularly prevalent, making it crucial to implement strong security measures to protect customer data.

Pharming

Pharming is a more sophisticated and harder-to-detect version of phishing. It involves altering DNS addresses so that a fake website appears identical to the legitimate one, even with a credible URL. This allows hackers to gather sensitive data from unsuspecting visitors, posing significant risks to both individuals and businesses.

Credit Card Reward Point Fraud

Also known as loyalty fraud or points fraud, this scheme exploits customer loyalty programs. Scammers request sensitive details under the guise of redeeming non-existent rewards. These scams are effective because they prey on the trust customers have in established reward schemes.

Clickbait Scams

Clickbait scams lure victims with enticing offers, such as winning a trip to the Bahamas. Once the victim clicks the link, the scammer gains their trust and solicits private information. Despite being an old tactic, clickbait remains a potent tool for fraudsters due to its compelling nature.

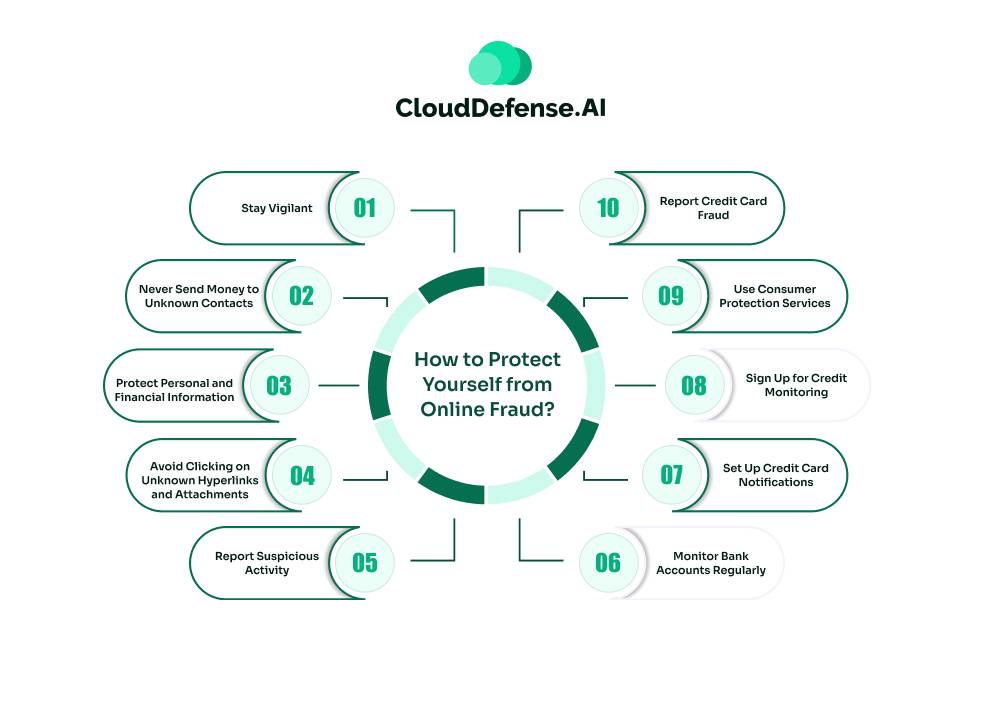

How to Protect Yourself from Online Fraud?

Internet users must remain vigilant to protect themselves from the various types of online fraud. Awareness and proactive measures are essential to avoid becoming a victim of these deceptive practices. Here are some crucial steps to safeguard yourself from online fraud:

Stay Vigilant

Understanding common types of internet fraud, such as those mentioned above, is the first line of defense. Recognizing phishing scams, identity theft, and other fraudulent activities helps you stay alert to potential threats.

Never Send Money to Unknown Contacts

One golden rule to prevent online fraud is to never send money to someone you meet over the internet. Scammers often create fake personas to build trust and then solicit funds. Always verify the legitimacy of individuals or organizations before making any financial transactions.

Protect Personal and Financial Information

Be cautious about sharing personal or financial details. Only provide such information to legitimate, trustworthy sources. Avoid sharing sensitive information through email or instant messaging, as these channels can be intercepted by fraudsters.

Avoid Clicking on Unknown Hyperlinks and Attachments

Phishing emails and messages often contain malicious hyperlinks and attachments designed to steal your information. Always verify the sender’s identity before clicking on any links or downloading attachments. If something seems suspicious, it’s best to err on the side of caution and avoid interaction.

Report Suspicious Activity

If you encounter online scammer activity or receive phishing emails, report them to the authorities immediately. Prompt reporting can help prevent others from falling victim to the same scams and assist in tracking down the fraudsters.

Monitor Bank Accounts Regularly

Keep a close eye on your bank accounts to detect any unauthorized transactions. Regularly reviewing your account statements can help you spot fraudulent activity early and take swift action to mitigate the damage.

Set Up Credit Card Notifications

Most credit card companies offer notifications for card activity. Enable these alerts to receive real-time updates on transactions, helping you quickly identify and respond to any suspicious activity.

Sign Up for Credit Monitoring

Credit monitoring services provide an additional layer of protection by alerting you to changes in your credit report. These services can help detect identity theft and other fraudulent activities early, allowing you to take action before significant damage occurs.

Use Consumer Protection Services

Many financial institutions offer consumer protection services that can help safeguard your accounts. Take advantage of these services to enhance your security and reduce the risk of fraud.

Report Credit Card Fraud

If you suffer credit card fraud, report it immediately to the relevant legal authorities and credit bureaus. Quick reporting is crucial to prevent further unauthorized use of your card and to start the process of reclaiming your funds and restoring your credit.

Final Words

Protecting yourself from online fraud requires vigilance and proactive measures. By staying informed about common scams, safeguarding your personal information, and monitoring your financial accounts, you can reduce your risk. Remember, never send money to unknown contacts and always verify the legitimacy of requests. If you suspect fraud, report it immediately. Stay cautious, trust your instincts, and prioritize your digital security to stay one step ahead of cybercriminals.